Order for payment: how to obtain it?

The injunction to pay is an effective judicial collection procedure. Indeed, if a company is confronted with an unpaid invoice that it has not collected amicably from a customer, it can use the injunction to pay procedure. Fast, simple and inexpensive, it is indicated if you have the elements that justify the validity of your claim (purchase order, invoice, etc.) and if your debtor has not issued a dispute. This legal procedure, properly executed, most often encourages bad payers to pay you. It can also, in certain cases, force payment when the court decision has not been challenged within the time limit. Here's how it works.

Injunction to pay: definition and interest

What is a payment order?

The injunction to pay is a judicial procedure for the collection of debts.

Simple and quick to implement, it is also inexpensive and relatively effective for obtaining payment of your unpaid invoices if amicable collection has not been successful.

It can be carried out as soon as your claim is :

- Due: you provide proof of the validity of the claim, once the settlement deadline has been reached

- Certain: you can prove that the amount of your outstanding debt is explicitly defined (the invoice is a piece of evidence)

- Or arises from a contract and there are no conditions precedent

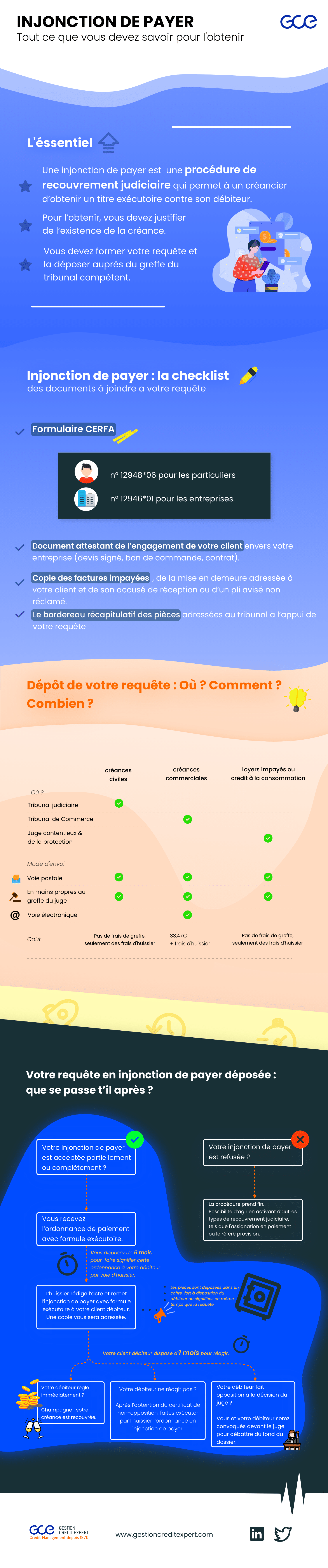

The assistance of a lawyer is not mandatory, only a few documents are needed to start the procedure:

A query containing :

A duly completed CERFA form (n° 12948*06 if your customer is an individual and n° 12946*01 if your customer is a company). The information requested is basic (identity of the creditor and debtor, as well as the amount of unpaid bills),

A document attesting to your customer’s commitment to your company (signed quote, purchase order, contract,..),

A copy of the unpaid invoices , of the formal notice sent to your client and of its acknowledgment of receipt or of an unclaimed notified letter.

All these documents must be sent to the Registry of the competent Court.

Good to know:

The order must be served on the debtor before the end of the limitation period for your claim because only this service will interrupt the limitation period. If the usual time limits for the processing of IP (injunctions to pay) by the competent court are not known, it is therefore better to take action well in advance, or even prefer a summons for payment.

Reminder also of the definition of a claim on this page.

Why choose this legal collection procedure?

The injunction to pay has two major interests:

- Obtain a favorable decision from the Court based solely on the evidence provided by the creditor,

- Settle your unpaid problem quickly, without having to debate the merits of the case between you and your client before a judge (except in the case where the debtor objects to the payment order).

Order for payment: key steps

You have chosen to go to court to recover your debt. Discover all the steps of the procedure.

1) To which court should I apply for an injunction to pay?

The nature of your outstanding debt determines the court to which you should apply for an order for payment:

- Your claim is civil (your debtor client is an individual): you must make your request to the President of the Judicial Court. There is no registration fee for this application.

- Your claim is commercial (your debtor customer is a company): you must address your request to the President of the Commercial Court. You must accompany your file with a check of 33,47 € TTC to the order of the Clerk of the Commercial Court. In addition, there are the bailiff’s fees.

- If your claim is for unpaid rent or consumer credit, you should go to the Judge of Litigation and Protection.

You must send your request to the court closest to your debtor’s place of residence:

- If your client is a private individual, you should contact the judicial court in his or her municipality of residence.

- In the case of a dispute with a company, bring the matter before the commercial court having jurisdiction in the place of its head office.

Good to know:

Les tribunaux mentionnés ci-dessus sont compétents quel que soit le montant de la créance pour laquelle vous souhaitez une injonction de payer.

Retrouvez tous les contacts utiles dans cet annuaire en ligne. N’hésitez pas à téléphoner au tribunal en amont pour vous assurer de sa compétence à traiter votre requête.

Vous pouvez adresser votre requête par voie postale, en mains propres au greffe du juge compétent, ou par voie électronique devant les tribunaux de commerce.

2) If the judge denies your order:

The judge may decide to deny your motion for an order for payment if he or she finds either that :

- The claim is unfounded,

- Supporting documents are not sufficient,

- The amount/complexity warrants an adversarial debate,

- The claim is time-barred,

- The procedure does not fall under its jurisdiction.

In this case, the procedure ends. The creditor can still take action by activating other types of judicial collection, such as the summons for payment or the provisional summary judgment.

3) The order for payment must be served by a bailiff if the judge accepts your request

If the judge decides in favor of your request for an injunction to pay (partial or total), you will receive a payment order by mail. This document mentions all the amounts that the debtor is ordered to pay you:

- The principal amount of your claim,

- Interest,

- If applicable, the court fees paid at the time of your application to the commercial court.

- If the judge grants it to you, the indemnities provided for in article 700 CPC or L.441-10 II of the commercial code relating to the recovery costs that you will have justified beforehand.

You then have 6 months to bring the order for payment to the attention of your debtor client. However, after this period, the order for payment procedure stops and the benefit of the order lapses.

The bailiff is the only person authorized to serve the order to pay on your debtor.

Here are the next steps in your appeal:

- You contact a bailiff practicing in the department of your debtor client

- You forward the judge’s payment order to him.

Order for payment: what’s new since March 1, 2022

The reform of the injunction to pay procedure that went into effect on March 1, 2022 provides that:

- The creditor shall send all supporting documents and the summary of documents to the court in support of the petition,

- The bailiff makes the supporting documents available to the debtor via a dedicated website,

- The bailiff draws up the document that will serve the payment order on your client. The first original will be sent to him, the second will be reserved for you.

- The executory formula is now immediately affixed to the order issued by the President of the Court if the judgment is in favor of the creditor. In other words, once the debtor’s objection period has elapsed, you will no longer need to return to the court to ask it to affix the executory clause because it will be there as soon as the judge issues the order. Also, the bailiff will be able to proceed to the forced execution.

Good to know:

L’intervention d’un huissier représente un coût. Il peut varier en fonction de la somme à recouvrer. Ces frais pourront dans certains cas être ajoutés à l’ordonnance de paiement pour vous être remboursés par le débiteur lui-même s’il est solvable.

Order for payment procedure: the follow-up depends on the debtor’s reaction

The debtor is usually not aware of your legal action until contacted by the bailiff. Your client has one month from the date of receipt of the payment order to respond. Either:

- The debtor immediately settles the debt and your debt is collected.

- He does not respond to the payment order. Send the second original of the bailiff’s deed to the Clerk of the Court so that he can send you an enforcement order. This document allows for example the bailiff to execute the court decision by seizure on the debtor’s bank accounts (there are many other ways of execution). Once again, this procedure represents a bailiff’s fee. You will be able to recover them by adding them to the sums mentioned on the order for payment if your debtor is solvent.

- He files an objection to the judge’s decision. The Clerk’s Office informs you of the judgment by mail. If your claim is commercial and you have sent your request for an order to pay to the Commercial Court, you have 15 days to send the court fees to the court, otherwise the order to pay will lapse. The judge then calls the two parties to a hearing to discuss the merits of the case.

Good to know:

L’accompagnement par un avocat peut être nécessaire en cas d’opposition de votre débiteur, a fortiori si le mauvais payeur se fait lui-même représenter.

Si le montant de la créance est supérieur à 10 000€, l’intervention d’un avocat sera obligatoire.

En revanche, elle n’est pas obligatoire devant le juge des contentieux de la protection, quel que soit le montant.

Delegating the payment order procedure: the advantages

You can choose to entrust the management of your order for payment procedure to a professional organization:

- 1st advantage: To save precious time

Putting together your application, finding the right court and the right bailiff for your procedure are necessary but time-consuming steps. So by outsourcing these tasks to experts, you can refocus on your core business. Collection companies such as GCE can provide you with experts with specific skills and the time to dedicate to dunning/collection activities.

- 2nd advantage: To preserve your image

By calling on professionals to settle your dispute, you benefit from the expertise of a neutral intermediary experienced in negotiation methods. Indeed, you will not have any direct contact with your client for these delicate and complex issues.

- 3rd advantage: To increase your chances of recovering your cash quickly

By entrusting the management of your unpaid bills to a third party, you show your debtor the seriousness of your intentions. Your customer quickly understands that your partner will go to any length to get the payment you are owed. This procedure generally encourages debtors to pay their debts quickly.

- 4th advantage: To optimize your legal costs

Collection companies are regular (even very important) clients of lawyers and bailiffs. They know how to optimize their interventions in time and cost. In addition, they benefit from privileged tariff conditions for all the services of these essential intermediaries (except for legal acts whose tariffs are regulated).

In conclusion, the injunction to pay is a simplified procedure which allows the creditor to take rapid action to recover the debt. Most of the time, this procedure allows to obtain the payment of the amount due from the debtor. However, the action of a collection agency will facilitate and lighten your steps so that you can save time on administrative procedures and remain focused on your business.